At a Glance

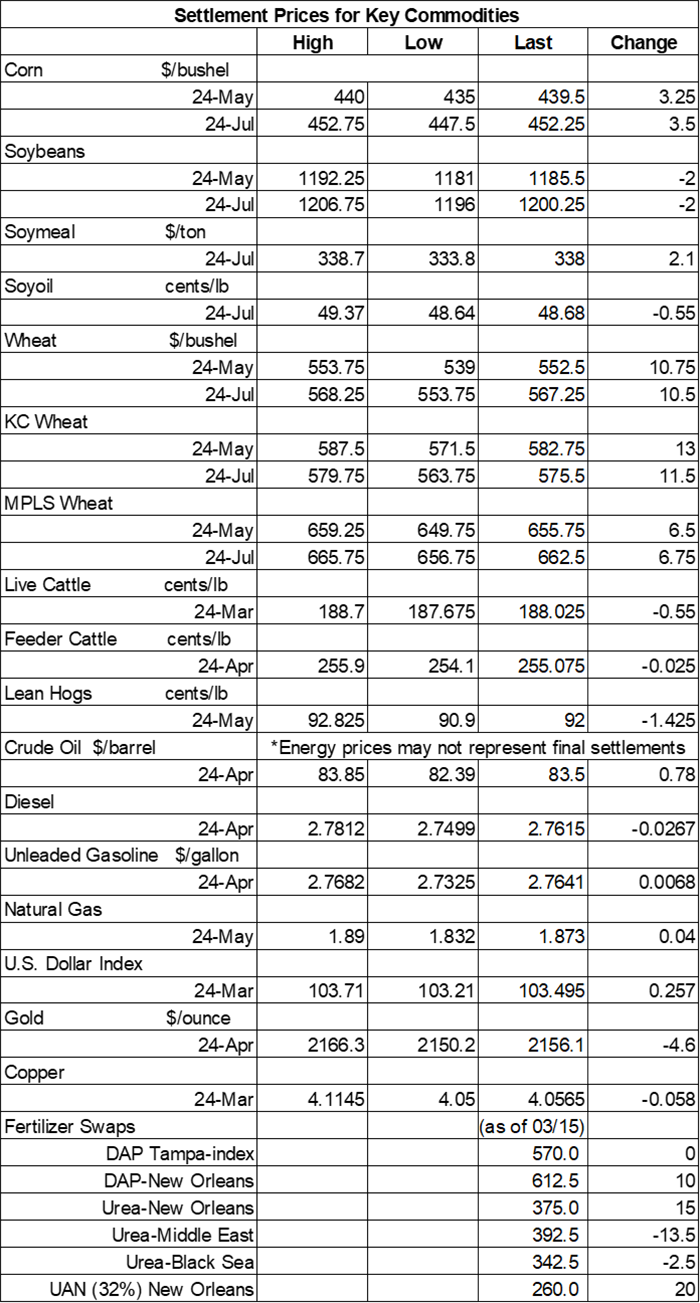

- Corn prices improve 0.75%, with some wheat contracts trending more than 2% higher

- Soybeans fade slightly lower in choppy session on Tuesday

- Plus: Soybean exports slump, but crushing pace has hit record volume so far this year

Grain prices were mixed but mostly higher on Tuesday. Winter wheat contracts found a double-digit bounce as traders are still assessing the latest attacks in Ukraine. Spring wheat futures firmed 1%, and corn futures were up around 0.75%. Soybeans failed to follow suit, incurring modest losses today.

Variable rains are possible for a large section of the Corn Belt between Wednesday and Saturday, but few fields are likely to gather much more than 0.25” later this week, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts seasonally wet, cold weather for the Midwest and Plains between March 26 and April 1.

On Wall St., the Dow trended 236 points higher in afternoon trading to 39,026 as traders awaited the next Federal Reserve decisions involving interest rates and were further supported by falling Treasury yields. Energy futures were mixed but mostly higher, with crude oil up another 0.75% this afternoon to $83 per barrel. Gasoline firmed slightly, while diesel eroded almost 1% lower. The U.S. Dollar

On Monday, commodity funds were net buyers of CBOT wheat (+5,500) contracts but were net sellers of corn (-1,000), soybeans (-3,500), soymeal (-2,000) and soyoil (-2,500).

Corn

Corn prices made moderate inroads on Tuesday on a round of short-covering and technical buying, gaining some additional spillover support from rising wheat prices. May futures added 3.25 cents to $4.3925, with July futures up 3.5 cents to $4.5225.

Corn basis bids trended 2 to 4 cents higher at two Midwestern processors while holding steady elsewhere across the central U.S. on Tuesday.

China has approved a total of 30 genetically modified corn and soybean varieties (27 corn, 3 soybeans) in its ongoing strategy to become less dependent on grain imports. The country made the move after pilot projects showed promising results in yield improvements. China currently imports more than 100 million metric tons of grains annually.

“If you like fast-paced action, the eight meetings to set monetary policy held each year by the Federal Reserve may not be must-see TV,” notes grain market analyst Bryce Knorr. Even so, the Fed’s two-day meeting that wraps up tomorrow could have a potentially significant impact on farmers. Knorr explains what’s going on in yesterday’s Ag Marketing IQ blog – click here to learn more.

Like many of you, pre-planting work has already begun for Indiana farmer Kyle Stackhouse. So far, that has included general farm clean-up, plumbing his new fertilizer tank, installing control wire for an irrigation well that was put in last fall, and much more. Catch up with what else Stackhouse has been doing lately in his latest Between the Fencerows blog – click here to learn more.

Preliminary volume estimates were for 212,434 contracts, which was slightly above Monday’s final count of 210,097.

Soybeans

Soybean prices tested modest gains at times during a choppy session on Tuesday but ultimately settled with small losses after a net round of technical selling. May and July futures each faded 2 cents lower to close at $11.8575 and $12.0025, respectively.

The rest of the soy complex was mixed. May soymeal futures moved more than 0.5% higher, while May soyoil futures eroded more than 1% lower.

Soybean basis bids were steady to mixed across the central U.S. after tracking as much as 6 cents higher at an Iowa river terminal and as much as 5 cents lower at an Indiana processor on Tuesday.

It’s a “good news, bad news” situation for soybeans in recent history. The bad news is that U.S. soybean exports are at the lowest levels since the 2019/20 marketing year. However, U.S. soybean crush volume have reached record levels in each of the past five months. As a recent example, NOPA reported a February crush of 186.2 million bushels, which was the best February volume on record and 15.4% above the long-term average of 161.3 million bushels.

If you didn’t make it to this year’s Commodity Classic, Farm Progress editors Curt Arens and Sarah McNaughton discussed their experience attending the event in the latest FP Next podcast – click here to listen.

Preliminary volume estimates were for 185,695 contracts, trending slightly above Monday’s final count of 171,644.

Wheat

Wheat prices continued to push higher on another round of technical buying that is partly spurred by recent Russian attacks on Ukrainian ports and other infrastructure. May Chicago SRW futures rose 10.75 cents to $5.5350, May Kansas City HRW futures climbed 13 cents to $5.8675, and May MGEX spring wheat futures added 6.5 cents to $6.5725.

Iraq’s minister of commerce reported that the country’s wheat stocks are currently around 73.5 million bushels, according to a statement issued today. Because of that, Iraq’s wheat needs are self-sufficient for the remainder of 2024 and will not be importing additional wheat this year.

Japan issued a regular tender to purchase 4.4 million bushels of food-quality wheat from the United States, Canada and Australia that closes on Thursday. Of the total, 55% is expected to be sourced from the U.S. The grain is for shipment between April 21 and May 20.

Jordan issued an international tender to purchase 4.4 million bushels of milling wheat from optional origins that closes on March 25l The grain is for shipment in June and July.

And finally, did you know today is National Ag Day? Farm broadcaster Mike Pearson shares the story of how the day came to be by the Agriculture Council of America to raise the profile of our nation’s farmers to both private citizens and public policy makers in today’s edition of Farm Progress America – click here to listen.

Preliminary volume estimates were for 89,962 CBOT contracts, shifting slightly below Monday’s final count of 98,118.

About the Author(s)

You May Also Like