At a Glance

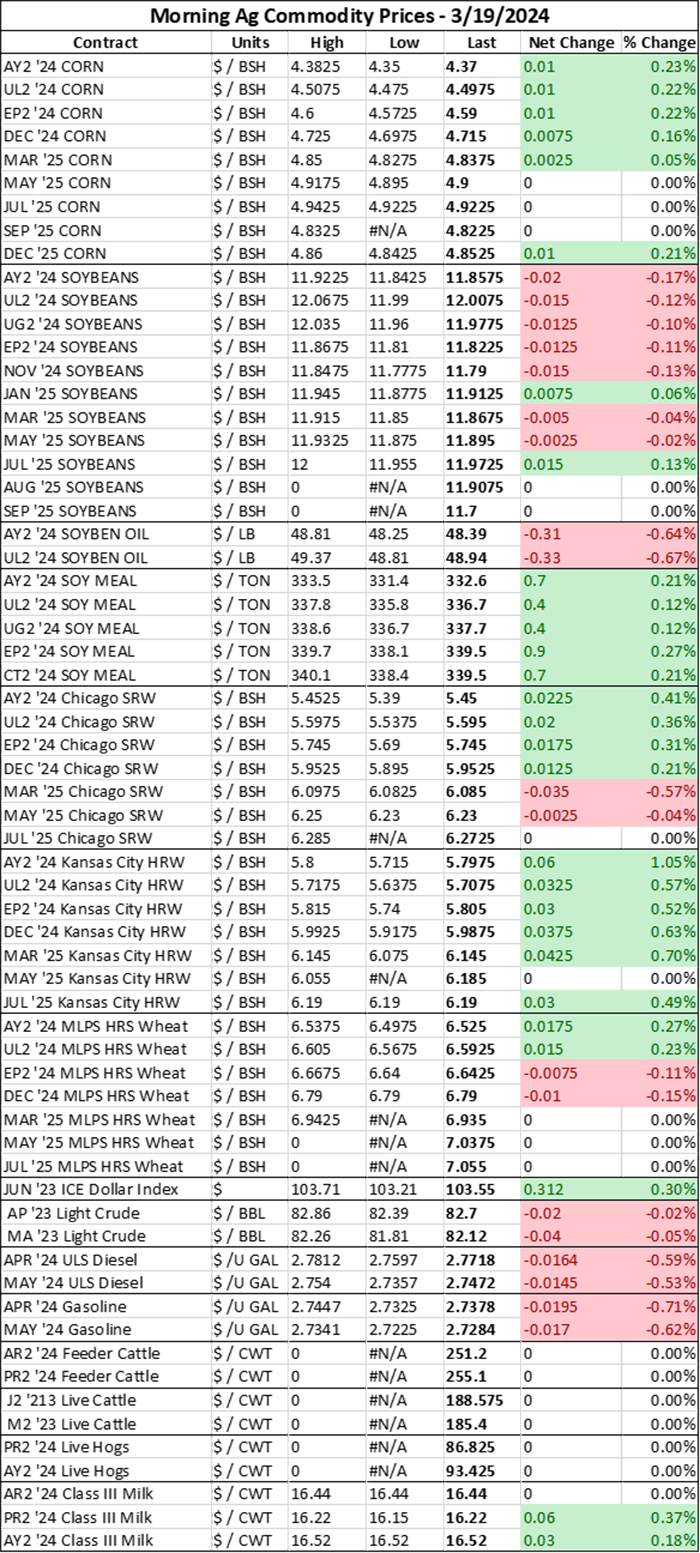

- Corn up 1 cent

- Soybeans down 1-5 cents; Soyoil down $0.45/lb; Soymeal down $0.10/ton

- Chicago SRW wheat up 5-7 cents; Kansas City HRW wheat up 5-8 cents; Minneapolis spring wheat up 5 cents

Prices updated as of 6:55am CDT.

Good morning!

The spring equinox takes place at 9:06 PM MT this evening, which makes today the first day of spring! Spring is my favorite season – it’s peak race season, everything is growing, it’s peak asparagus and rhubarb season. And most importantly, it means that we are over a week away from USDA’s first look at 2024 acreage intentions!

Truly the most wonderful time of year! Happy Spring, everyone!

Corn (and financials)

It was a quiet night in the overnight markets, particularly for corn and soybeans. Corn futures traded flat to nearly a penny higher on the lack of new market updates. Nearby May24 prices edged up to $4.3725/bushel while new crop Dec24 futures rose to $4.7175/bushel.

A slightly stronger dollar overnight and steady planting progress in Brazil kept corn’s price gains in check this morning. The dollar is strengthening on concerns that the Federal Reserve is not going to decrease interest rates until June – perhaps not at all this year, according to former Treasury Secretary Larry Summers – as the Fed begins its two-day Federal Open Market Committee (FOMC) meeting today.

If the Fed doesn’t drop interest rates, that could make accessing margin money to play into the stock market more expensive for investors. It also reflects doubts on the U.S.’s ability to thwart inflationary pressures in the economy and makes investors prefer safe-haven assets – like the dollar – more because they can offer a more reliable rate of return while the market is still jittery about the economic outlook.

So it should come as no surprise that S&P 500 futures are trading 0.49% lower this morning to $5,189.00 at last glance. The higher economic uncertainty sends investors seeking safer assets – like the dollar – and away from more risky securities, like equity markets.

But that isn’t good news for ag markets, as a higher dollar makes U.S. grains and oilseeds more expensive to overseas buyers. These financial market sentiments are spilling over into the grain and oilseed arena this morning as the FOMC meeting is in full focus. It is a key driver in lower soybean prices this morning and is limited gains in the corn and soybean markets.

The Fed concludes the two-day FOMC meeting tomorrow, at which time it will issue further rate guidance and an updated economic outlook. Expect financial and ag markets to derive price action from the comments following the FOMC meeting.

Soybeans

Soybean prices started Tuesday’s trading session flat to nearly two cents lower, dropping nearby May24 futures prices to $11.86/bushel and new crop Nov24 futures to $11.7925/bushel at last glance.

As mentioned earlier, financial market pressure and a stronger dollar are limiting soy’s upward price momentum today. But increasingly rapid Brazilian soybean export shipments as its harvest season progresses are also fueling losses in the soy complex this morning.

Wheat

Wheat prices ignored a stronger dollar this morning and extended yesterday’s rally to rise $0.02-$0.08/bushel during the overnight trading session. There are a lot of dynamics at play in the wheat market this week, especially after Ukraine began targeting Russian oil refineries in recent days, which is casting doubts on the stability of Black Sea wheat shipments after Russia retaliated by launching missile strikes at grain loading and storage facilities at Ukraine’s key Odesa port.

Prior to these strikes, Russia and Ukraine were shipping wheat at a rapid clip and limiting upward price mobility for all other wheat producers around the world. With the exception of Argentina, who has been able to compete with Black Sea supplies in recent months thanks to significantly lower shipping costs.

“Large short positions built up by investors during the recent decline in prices have made the wheat market liable to short-covering rallies, but analysts said huge supply in top exporter Russia hung over the market,” Gus Trompiz and Peter Hobson reported for Reuters this morning. “Forecasters are anticipating a third consecutive bumper harvest in Russia this year, which could contribute to record global grain production.”

Wheat markets are also likely to be price responsive to a ruling expected from the European Union this week that could impose tariffs on Russian grain imports as well as a decision to impose import quotas on Ukrainian grain shipments, which have flooded local Eastern European markets and depressed local cash prices in the wake of restricted Black Sea shipping access.

Ukraine is the European Union’s largest grain supplier. But the flood of grain shipments after Russia restricted Ukraine’s access to shipping terminals in the Black Sea after the Black Sea Grains Initiative expired last summer has been more than European wheat producers can bear, from a local cash price perspective.

The additional grain flowing across land borders is limiting profitability prospects for farmers in European countries neighboring Ukraine and has been a point of contention for European farmers amid protests across the continent during this past winter.

Winter wheat conditions in top U.S. wheat-producing states are improving, but that could hinder price improvement for U.S. wheat, especially after Chicago soft red winter (SRW) wheat futures prices dipped to a pre-Ukrainian conflict low during last week’s trading sessions.

USDA found 55% of Kansas winter wheat to be in good to excellent condition over the past week, up 2% from the previous week thanks to recent precipitation events that moved across the Heartland late last week. Kansas is the U.S.’s top wheat producing state.

Winter wheat crop ratings in Texas (46% G-E) and Colorado (65% G-E) also improved by 2% and 9%, respectively, on the week. Crop ratings in Oklahoma declined 4% over the past four weeks to 61% good to excellent.

Winter wheat crops are in better condition now than they were this time last year, but dry weather remains a risk. Through March 12, 14% of winter wheat acreage was located in a drought-stricken area. About 30% of spring wheat acres and 25% of durum wheat acres are also in areas experiencing drought.

USDA begins releases weekly crop progress reports in less than two weeks (April 1), so we will be able to measure crop conditions more closely at that point. While U.S. wheat crops appear to be in better shape than last year so far this year, there is still a lot of time to go until crops are harvested this summer.

Marketing and farm transition

I’m adding this to the newsletter again today because I think it highlights how important sound marketing plans can impact transition planning – which has been a hot topic at meetings this winter. Advance Trading’s Matt Buckingham recently wrote an Ag Marketing IQ column about how to structure your farm’s marketing plans while undergoing ownership transitions that I cannot recommend enough.

“A good definition of marketing is the process of securing revenue,” Buckingham explains. “Our ability to secure revenue is extremely important, especially during times when we have big events – such as farm transition – that make us slightly more vulnerable.”

Buckingham emphasizes long-term marketing strategies for farmers of all ages but highlights the additional risk younger producers assume while starting out in this business. Younger producers inherently have less wealth to rely on and are more susceptible to market downturns than their more seasoned counterparts.

Protecting revenue streams is particularly critical for this group, Buckingham stresses. “Scaling up and growing can be very impactful in both positive and negative ways,” he says. “Having a sound marketing plan and managing market risk is critical for the times when we are most vulnerable.”

What else I’m reading at FarmFutures.com this morning:

Hoping for a corn rally? Naomi Blohm is watching these three factors in hopes of higher prices.

Are farmers truly undersold on 2023 corn sales or is there just a lot of corn? Check out my recent E-corn-omics column for all the hot goss!

What is moving grain markets these days? Bryce Knorr investigates.

Senior editor Ben Potter reminds us that farmland values are still sizzling, even as commodity prices trend lower.

About the Author(s)

You May Also Like